Attractive, risk-adjusted returns

Emphasizing capital preservation in difficult markets, and believing in the ability to compound returns by limiting losses.

Active risk management

Seeking managers with a combination of fundamental research ability, dynamic risk management and trading acumen — because we believe these managers are more likely to stay liquid and protect capital in times of stress.

Control of size

Making significant allocations to managers that control their asset size — making them generally more liquid and flexible. By identifying talent early, we can negotiate favorable terms and future capacity.

Transparency

Fund information is shared with investors; Titan’s investor relations team provides extensive detail on portfolio holdings.

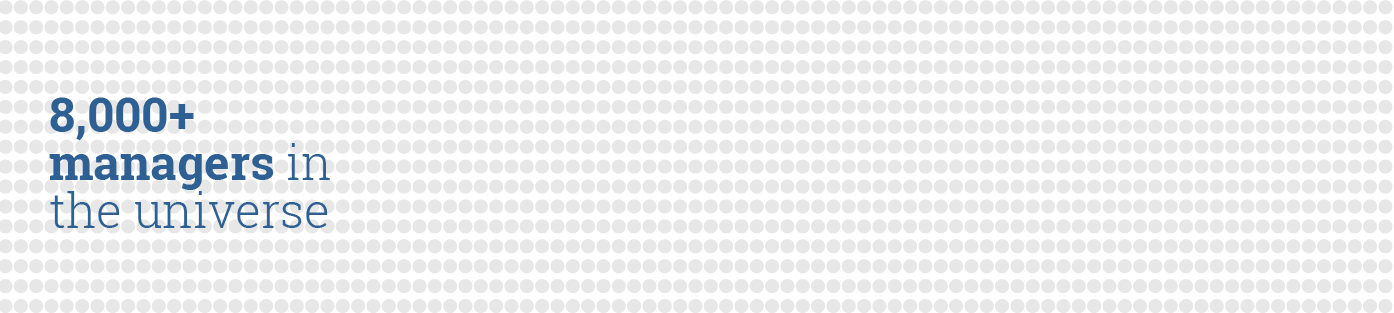

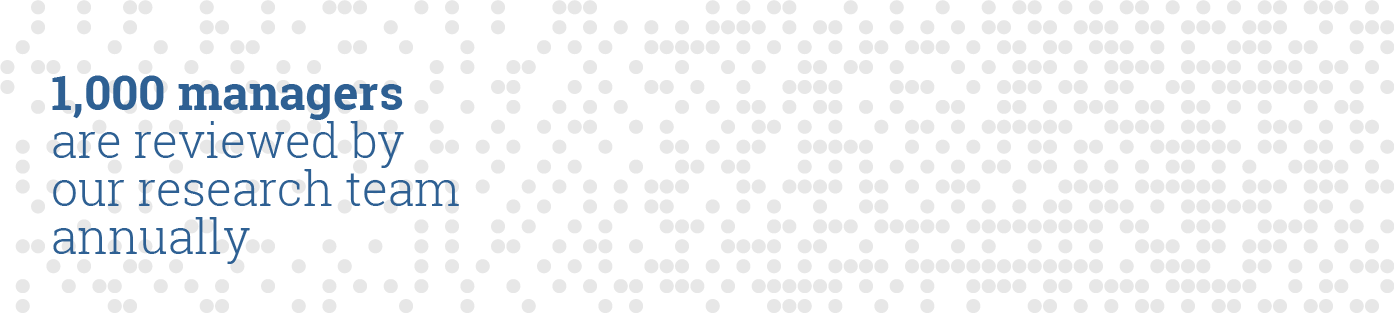

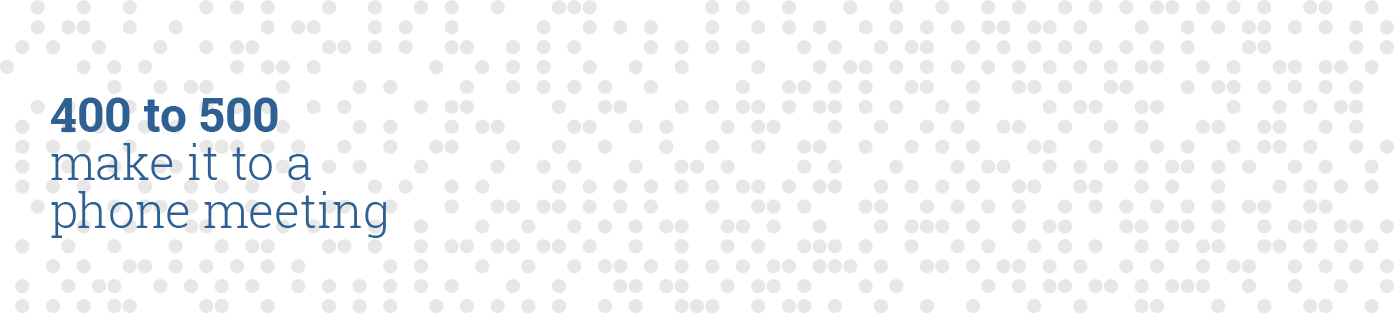

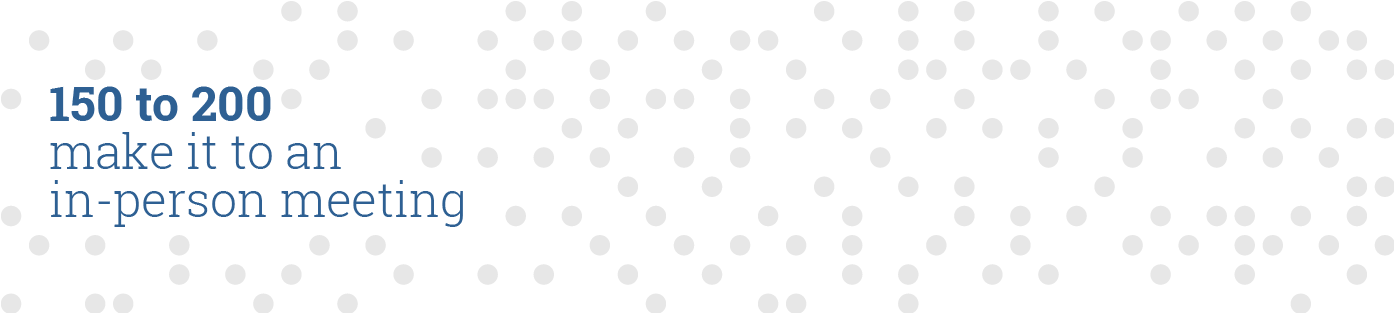

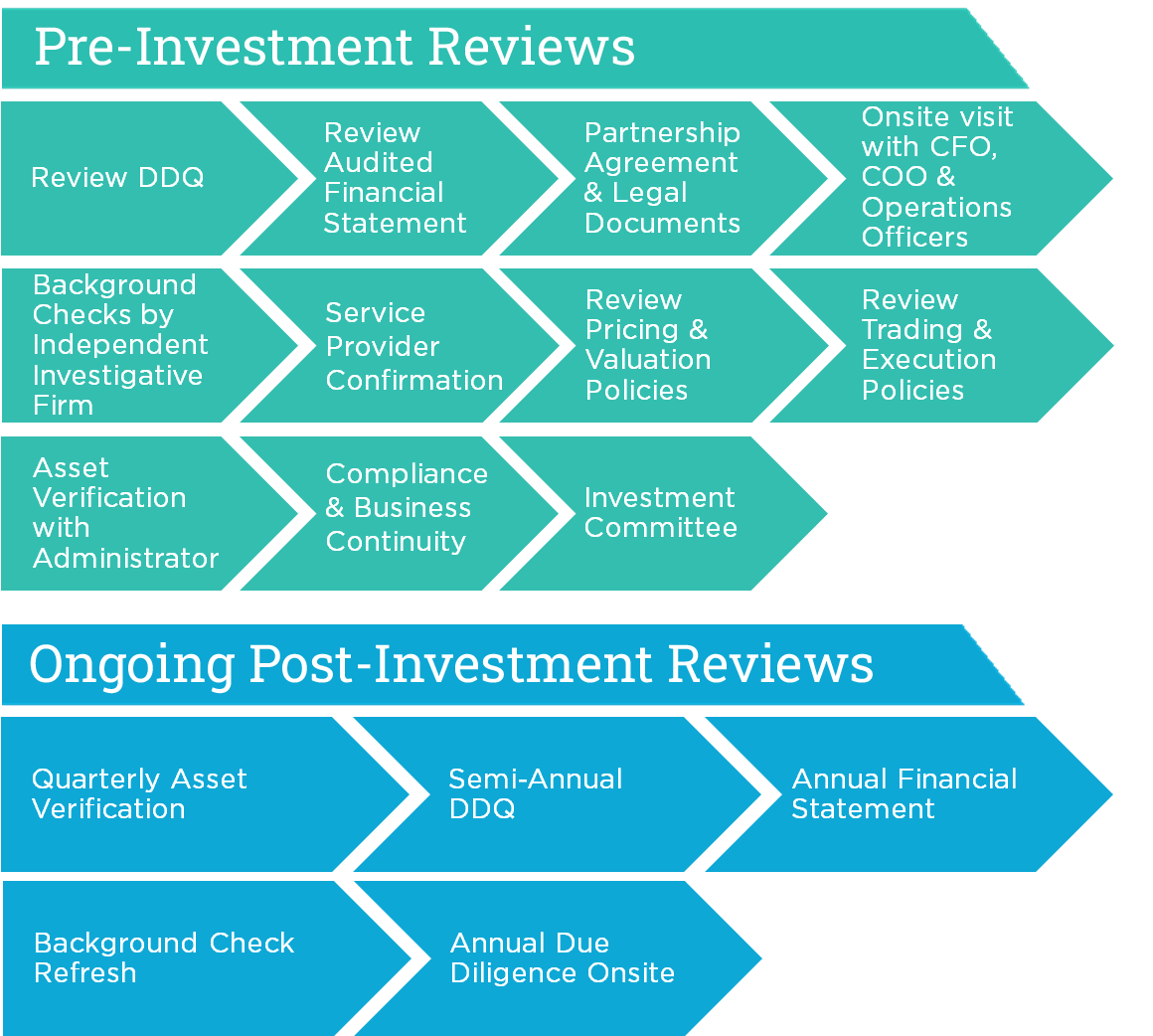

Our Manager Selection Process

Our Strengths

Careful research and analysis is critical to investment selection. We have an integrated investment approach that enables us to best identify alpha opportunities as well as build robust portfolios of these opportunities for our investors.

Committed to transparency, research professionals share notes among the team, as well as with our Custom Solutions investors via our proprietary technology platform.

Our Operational Due Diligence team is active in pre-investment manager vetting and provides regular and ongoing review. The Head of ODD has veto power, and reports to our COO who is an active participant in all company investment decisions.

Titan’s proprietary technology enables us to share information and research in real time across our teams, and with our Custom Solutions investors, as the accounting, research, risk and operational departments continuously update the system throughout the day.

Titan employs in-house and outsourced programmers to maintain and enhance the platform.